Internalization

Challenge

Sending all orders to the exchange blindly can be costly

Proprietary trading firms and large firms are sending many orders for buying and selling products to exchanges. Sending both a buy and a sell order for the same product on behalf of two customers can increase costs unnecessarily. And in some cases, out of compliance with exchange rules.

Solution

Easy order matching with CQG Care Orders and Internalization Engine

By using CQG's Internalization Engine, trading and commercial firms can now match orders internally, reducing exchange fees and compliance risk. CQG can send a MODES file or audit records with internalized orders to post to back office systems.

Firms can use either care orders to manually match, automatically match after a certain period of time or based on some criteria. Or, firms can use CQG's Internalization Engine to fully automate the process.

How it works

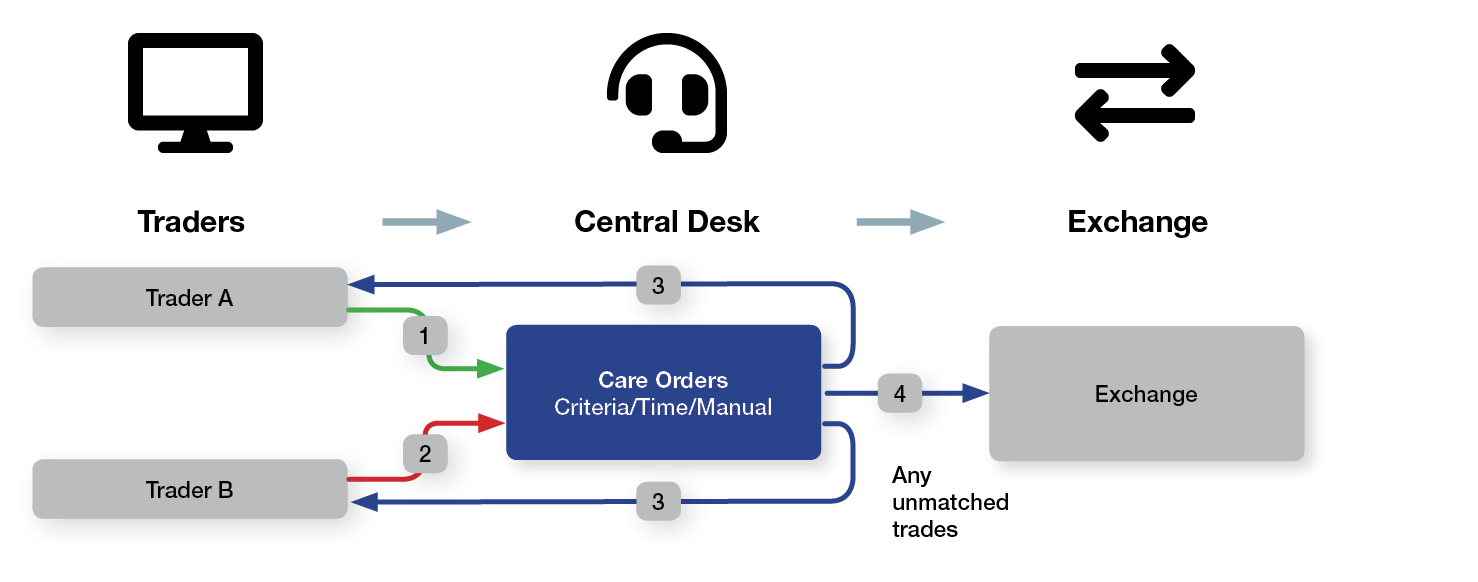

CQG Care Orders

- Trader A places an order. Order is parked at central desk.

- Trader B places an order. Order is parked at central desk.

- Central desk can fill orders automatically based on criteria, time, or manually match orders. Fills are sent to Traders A & B.

- Any unmatched trades can flow to the exchange based on criteria, time, or manually.

How it works

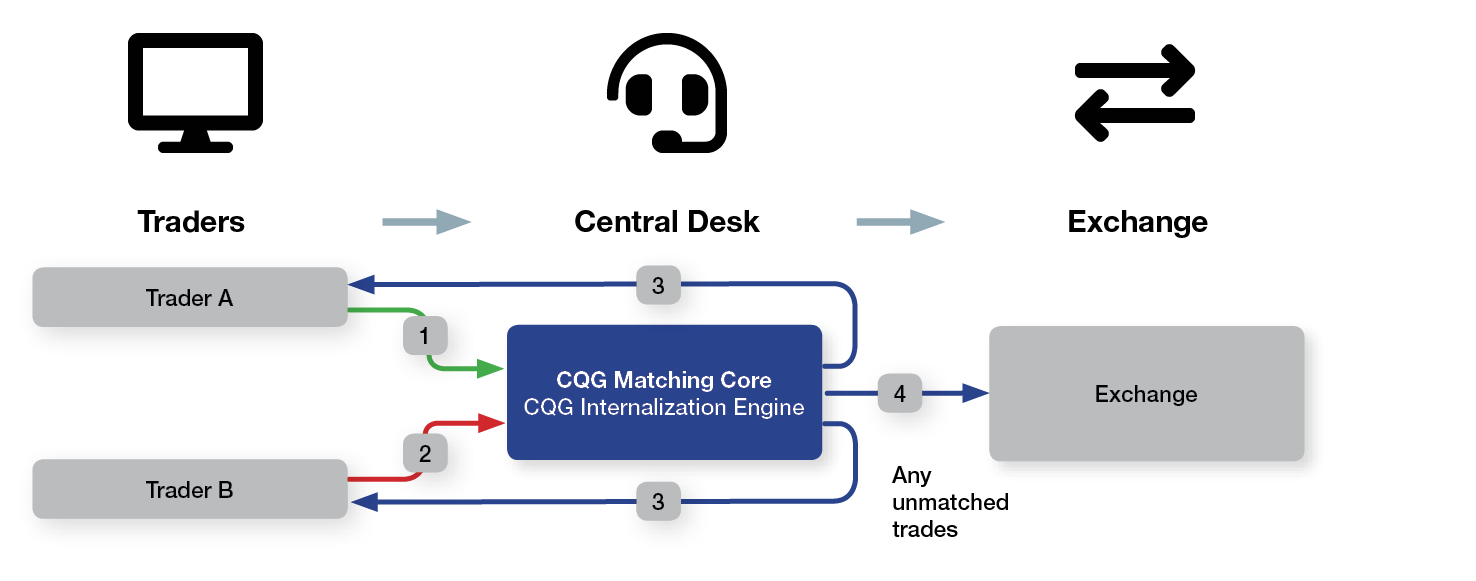

CQG Internalization Engine: Traders in the same firm

- Trader A places an order.

- Trader B places an order.

- CQG's Internalization Engine automatically matches orders based on criteria and sends fills back to the traders.

- Any unmatched trades flow to the exchange.