Ever evolving technological advances in electronic trading present us with unique opportunities and distinct challenges.

Capitalize on these and gain better control of your trading strategies with CQG Algos.

Market participants looking to execute large volumes of orders also endeavor to get the best price available in their market. The best price available can be nebulous: Is it attained by aggressively paying up for an immediate fill or by working the order over time? At the risk of the market slipping away, either is an option, but there is a better solution.

The above challenges led to the evolution of a new technology and tools to execute large orders: CQG Algos.

Challenge

Large Orders and Liquidity Risk

- The structure of futures markets creates slippage costs and other risks in the execution of larger orders due to the Central Limit Order Book.

- Executing a sufficiently large order at a fair price is often impossible. Placing large passive orders on the best bid or offer is prohibitive, as opposite liquidity often disappears as a result.

- It’s hard to balance the uncertainty of working an order over time versus paying a liquidity premium for immediate execution.

Solution

CQG Algos and Custom Algo SDK Advantage

- CQG Algo platform reduces implicit trading costs involved in accumulating a derivatives position.

- Each algorithm is built to track or beat benchmarks with specific implementations dedicated to in-depth analysis of microstructure, resulting in more passive fills.

- The platform employs a collocated low-latency algo engine.

- Algos react to real-time market data in microseconds, leveling the playing field with sophisticated market-making firms.

- CQG's Custom Algo SDK allows users to mix and match existing algos with custom algos, minimizing development and testing cycles.

CQG Algo Models

A new framework for fast execution

Economic

Economic Models mathematically optimize execution risk through short-term volatility, drift indicators, options-implied volatility, and statistical analysis.

Impact

The Market By Order Impact Model assures passive child orders are incognito and aggressive child orders maximize hit ratios.

The Percent of Volume Impact Model provides percent of volume guidance to restrict market share.

Payup

Payup model comprises several modes: Simple Size-based, Order Imbalance, Fair-Queue, and Theo-Queue. These modes maximize spread capture and reduce implicit trading costs.

Available

Arrival Price - Time is Money

Simulation Results - Detailed Analytics

Arrival Price uses short-term volatility and drift signals as well as market-implied volatility to execute within a risk-optimized time horizon using trader-defined slippage expectations.

VWAP - Trade the Market

Simulation Results - Detailed Analytics

VWAP uses a historical N day volume distribution, or a stochastic distribution augmented by short-term and implied volatility.

TWAP - Trade over Time

TWAP uses a Standard or Randomized sizing function that can optionally use MBO to create inconspicuous slices.

Icebergs - Trade Incognito

Random Iceberg, Stop Limit Iceberg, Stop Limit Sniper, Sniper

PayUp - Work an Order

Simple "with a tick" or more complex order imbalance measures.

Spreader - Leg Into a Spread

Latency Matters! Multileg Treasury, Energy, Equity or Ag spreads with an ultra-low latency spreader.

Coming Soon

Vola - Trade Volatility

Execute a hedged portfolio of options at a volatility level through legs or the complex order book.

Algo Parameters Technical Document

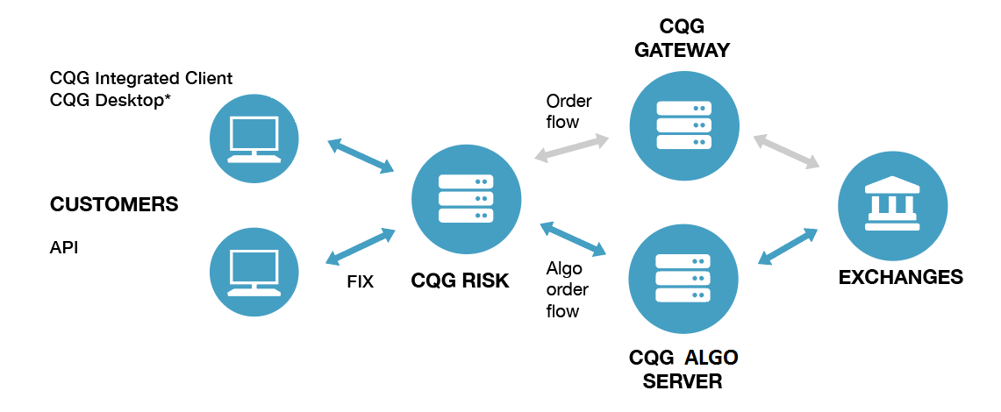

Technology Behind CQG Algos

Fastest execution through CQG software

CQG Algos deliver high-quality fills with the goal of reducing implicit trading costs involved in accumulating a derivatives position. The platform employs a collocated low-latency algo engine. The algo engine reacts in microseconds to changing market conditions for optimal management of child orders.

CQG Algos benefit from better queue position in FIFO markets through low-latency execution as well as lightning-fast analysis of Market By Order (MBO) books.

Each algorithm is built on sound macro-analytical precepts with specific implementations dedicated to in-depth analysis of the current market microstructure as well as employing high-level statistical analysis.

Algo Order types are available by appropriate market group Outright Futures, Futures Spreads, Options and Outright Options.

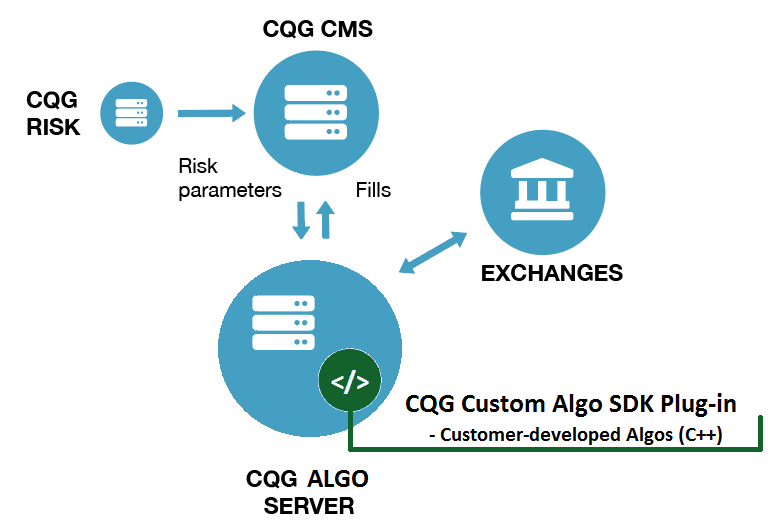

CQG Custom Algo SDK

Your algos on CQG's Algo Server

Create your innovative order types and algos with the intelligent models and simple process of our Custom Algo SDK. CQG Custom Algo SDK platform offers a sub-10 microsecond socket to socket response time for algorithmic trading. With your algos loaded into CQG's Algo Server, there is virtually no overhead. This allows your algorithm to take full advantage of the speed CQG Algo Server offers.