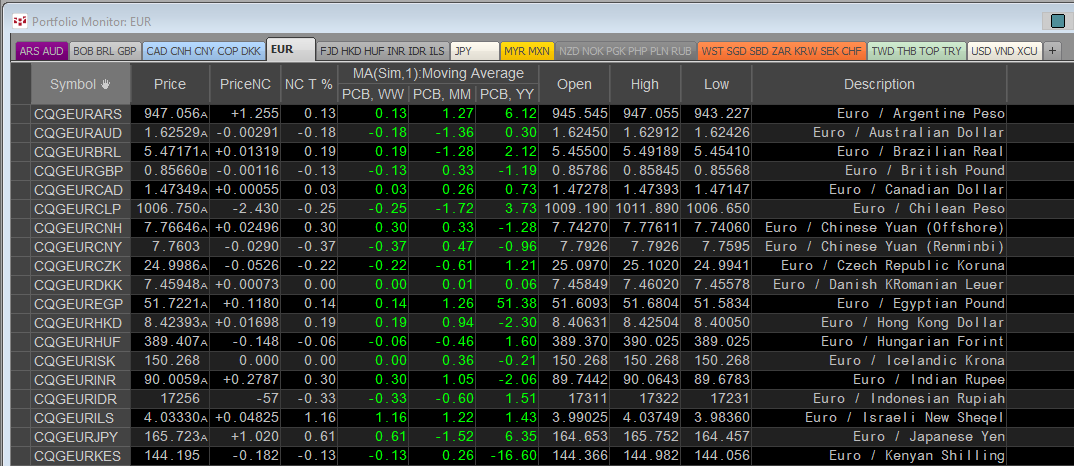

CQG offers institutional pricing data across 430+ currency pairs of market data. Sourced directly from tier-1 banks and non-bank market makers worldwide, the feed provides up to 50 years of historical data across multiple timescales is available. The enablement is CQG Global FX.

… more